Roofers employ meticulous protocols for comprehensive roofing assessments, crucial for insurance claims. These inspections involve climbing onto roofs, examining materials, flashing, gutters, and structural integrity for damage. They also delve into internal areas like attics to identify issues impacting roof performance. Detailed reports with photos and notes serve as vital documentation, aiding adjusters in accurately assessing damage and streamlining claims. Regular inspections prevent costly repairs, water damage, mold growth, and safety hazards, fostering collaboration between property owners and insurance assessors. Roofer professionals should adopt a systematic approach, documenting visible damage, conducting thorough walk-throughs, using specialized tools, and maintaining detailed records for efficient claims processing and proactive maintenance.

“As a roofer, inspecting roofs for insurance claims is a crucial task that demands precision and expertise. This article guides you through the essentials of roof inspection protocols, outlining key components of a comprehensive assessment. We’ll explore best practices for documenting damage and creating accurate reports, while also shedding light on common roof issues that significantly impact claims. Get ready to enhance your roofer skills in managing insurance-related roof conditions.”

- Understanding Roof Inspection Protocols

- Key Components of a Comprehensive Roof Assessment

- Documenting Damage: Creating Accurate Reports for Insurance Claims

- Common Roof Issues and Their Impact on Claims

- Best Practices for Efficient and Effective Roof Condition Reporting

Understanding Roof Inspection Protocols

Roof inspection protocols are designed to ensure thorough and consistent evaluations of roof conditions. When a roofer conducts an inspection, they systematically assess various elements like roofing materials, flashing, gutters, and structural integrity. This process involves climbing up to the roof, examining the surface for signs of damage, wear, or irregularities. They also look for potential issues inside the attic or crawl spaces, which can affect the roof’s performance.

The inspection report serves as critical documentation for insurance claims. Roofers detail their findings, including photographs and notes on repairs needed. This comprehensive report helps insurance adjusters accurately assess the extent of damage and facilitate a smoother claims process. By following established protocols, roofers ensure that every aspect of the roof is evaluated, providing an unbiased and detailed record for both parties involved in the claim.

Key Components of a Comprehensive Roof Assessment

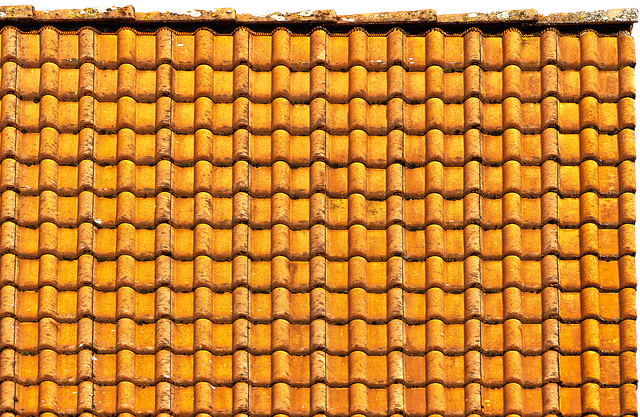

A comprehensive roof assessment is crucial for both insurance adjusters and roofer professionals. When inspecting a roof, several key components must be evaluated to provide an accurate report for insurance claims. The first step involves visually examining the overall structure, checking for any visible damage such as missing or damaged shingles, flashing issues, or signs of wear and tear. This initial assessment provides a high-level overview but may not reveal deeper problems.

Further inspection includes analyzing the roof’s drainage system, ensuring proper slope and alignment to prevent water accumulation. Roofer experts also assess the condition of soffits and fascias, which play a vital role in maintaining the integrity of the entire roofing system. Additionally, checking for mold or fungal growth, especially in damp areas, is essential as it can compromise structural stability and trigger health concerns. Detailed documentation of these findings ensures accurate insurance claims and facilitates effective repairs.

Documenting Damage: Creating Accurate Reports for Insurance Claims

When a roofer inspects a property for insurance claims, meticulous documentation is key. They must carefully assess every angle and surface of the roof, noting any damage or potential issues. This includes examining shingles for missing, damaged, or curled tiles; checking for signs of water leakage, mold growth, or rot; and assessing the overall structural integrity of the roof.

Accurate reports are crucial for effective insurance claims processing. Roofers should use clear, detailed language to describe each observed problem, including its location, severity, and potential causes. Visual aids like photographs and diagrams can significantly enhance these reports, providing concrete evidence that supports the assessment and streamlines the claims approval process.

Common Roof Issues and Their Impact on Claims

Common Roof Issues and Their Impact on Claims

Roof problems, if left unaddressed, can escalate into costly repairs or even pose safety hazards. One of the most prevalent issues is missing or damaged shingles, which not only compromise the roof’s structural integrity but also expose the property to elements like rain and snow, leading to water damage and mold growth. Another common problem is deteriorated flashing, often found around chimneys and vents, causing leaks that can result in significant insurance claims.

Roofer expertise is crucial for identifying these issues early on. Regular inspections by professionals can help prevent minor problems from becoming major, thereby reducing the likelihood of extensive damage and costly claims. By understanding common roof concerns, both property owners and insurance assessors can work together to ensure timely repairs and maintain the structural integrity of homes, ultimately saving time and money in the long run.

Best Practices for Efficient and Effective Roof Condition Reporting

When inspecting and reporting on roof conditions for insurance claims, roosters should prioritize a systematic approach. Start by thoroughly examining visible damage, including missing shingles, broken gutters, or signs of water intrusion. Document these findings with clear, detailed photos, noting the severity and location of each issue. Next, conduct a comprehensive walk-through of the entire roof surface, checking for subtle damage like cracks, curling, or uneven shading that could indicate underlying problems.

To ensure efficiency, use specialized tools like moisture meters to identify areas prone to water penetration. Additionally, keep detailed records of inspection dates, findings, and recommendations. Accurate and timely roof condition reporting not only facilitates smoother insurance claims processing but also promotes proactive maintenance, benefiting both homeowners and roofer professionals.

Roof inspections are a crucial step in the insurance claims process, requiring professional and thorough assessments. By understanding the protocols, documenting damage accurately, and being aware of common roof issues, roofer specialists can provide efficient reports that streamline the claims process. These practices ensure that policyholders receive fair compensation for their roof-related troubles, ultimately fostering trust and satisfaction in the industry.